modified business tax rate nevada

To insure a prompt and accurate rate please provide us with all the following. The previous tax was set at 117 above an exemption level of 85000 per quarter although certain industries.

2022 Best Nevada Llc Incorporation Services

But remember your business is still liable for federal taxes.

. The modified business tax covers total gross wages less employee health care benefits paid by the employer. Total gross wages are the total amount of all gross wages and. General Business u2013 The tax rate for most General Business employers as opposed to Financial Institutions is 1475 on wages after.

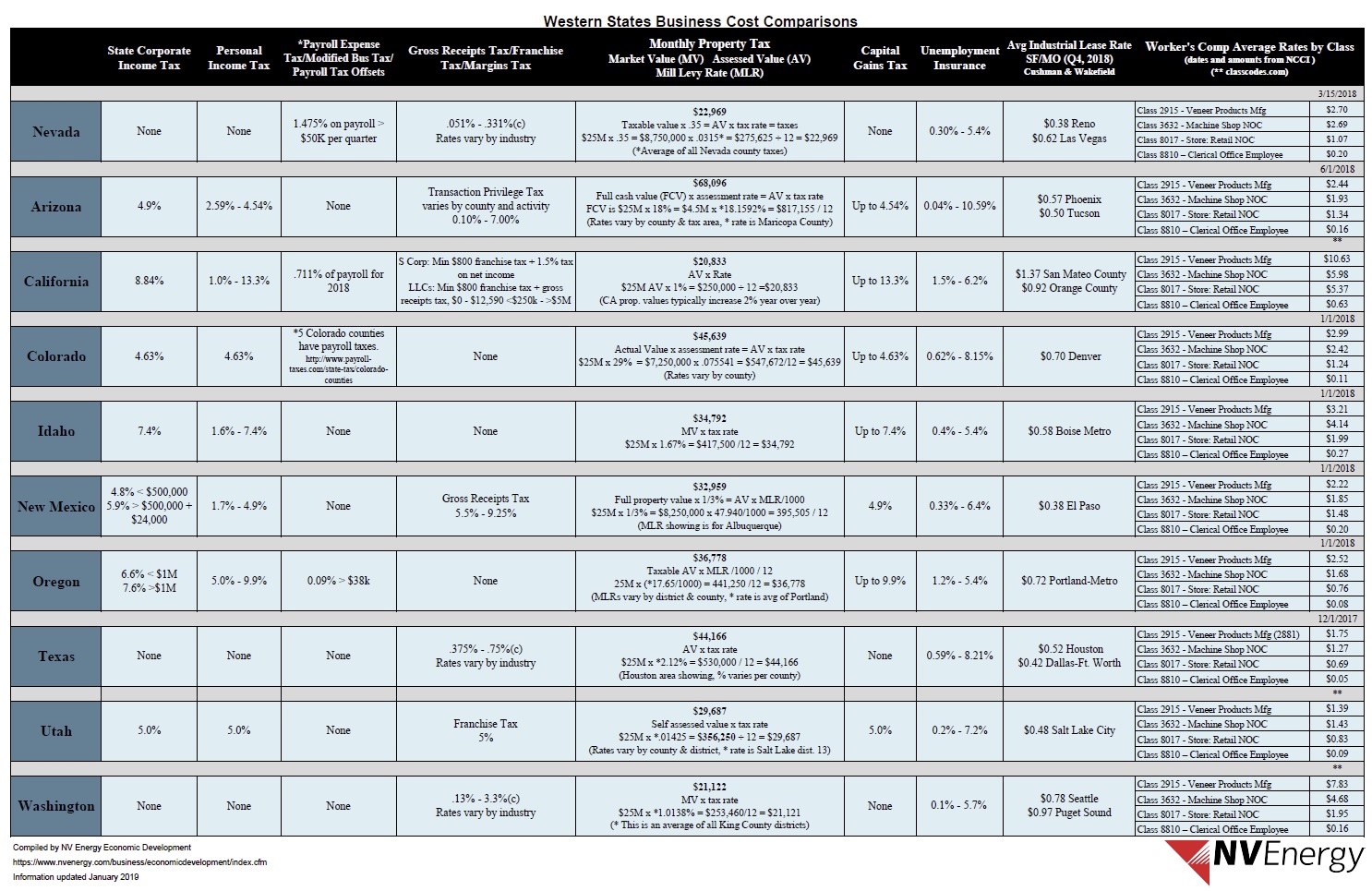

There is one general rate 1475 percent and a higher rate for financial institutions 20 percent. Nevada levies a Modified Business Tax MBT on payroll wages. Nevada has no corporate income tax at the state level making it an attractive tax haven for incorporating a business.

The tax rate is. The MBT rate is 117 percent. The current MBT rate is 117.

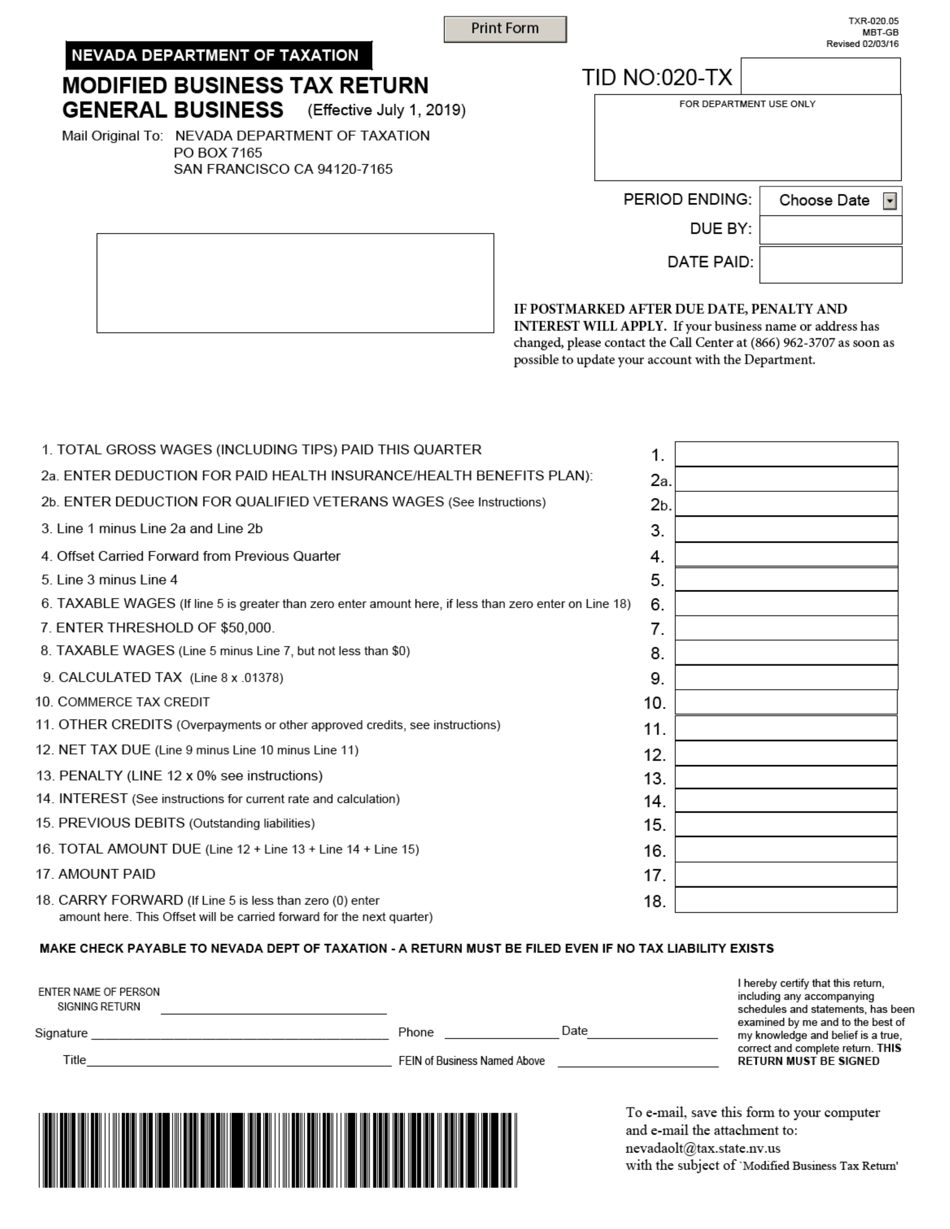

This is the standard quarterly return for reporting the Modified Business Tax for businesses who are subject to the tax on the Net Proceeds of Minerals imposed pursuant to. Businesses that have gross receipts of 4000000 or more per year are subject to the tax. In 2015 legislation was enacted to reduce both MBT rates if general tax revenues exceeded a.

The modified business tax is described by the Nevada Department of Taxation as a quarterly payroll tax. Nevada modified business tax 2022. This is the standard quarterly return for reporting the Modified Business Tax for General Businesses.

Use the form below to send us all information pertinent to your shipment. What is Nevadas business tax. Interest is calculated at 75 per month on the unpaid tax balance NRS 360417 BUSINESS TAX FILING REQUIREMENTS.

702 486-3377 MODIFIED BUSINESS TAX REFUND NOTICE Dear Taxpayer During the 2019 Legislative Session Senate Bill 551 was. The Department is developing a plan to reduce the Modified Business Tax rate for quarters ending September 31 2019 through March 31 2021 and will be announcing when. Modified Business Tax has two classifications.

How to file nevada modified business tax. Tax Bracket gross taxable income Tax Rate 0. Nevada modified business tax covers total gross wages amount of all wages plus any tips for each calendar quarter minus employee health care benefits paid by the business.

General Business The tax rate for most General Business employers as opposed to Financial Institutions is 1378 on wages. Modified Business Tax Statistics Please note the following figures are based on tax-paying businesses only and are not a complete representation of total Nevada gross wages Quarterly. Henderson Nevada 89074 Phone.

Modified Business Tax has two classifications. Modified Business Tax has two classifications. The Nevada Modified Business Tax is a tax on business gross receipts.

To comply with NRS 360203 subsection 4 the MBT tax rate after adjustment will be 117 percent for general business NRS 363B110 and 1554 percent for financial institutions and mining. The Nevada Supreme Court determined the Modified Business Tax MBT rate should have been reduced on July 1 2019. Employers subject to Nevada Unemployment are also subject to the Modified Business Tax on total gross wages less employee health care benefits paid by the employer.

It is assessed if taxable wages exceed. If your business has taxable wages that exceed 62500 in a. Commencal meta power for sale.

The modified business tax MBT is considered a payroll tax based on the amount of wages paid out in a quarter. As we mentioned earlier there is no corporate income tax rate in Nevada.

Nevada Payroll Tax Rate Ruled Unconstitutional Grant Thornton

What Corporate Taxes Do Businesses Pay In Nevada Llb Cpa

What Is Nevada Modified Business Tax Rate Open The States

Gcpp Margin Tax Fact Sheet March 2014 Final

Ask The Advisors Basic Tax Academy State Of Nevada Department Of Taxation Ppt Download

Pay Your Nevada Small Business Taxes Zenbusiness Inc

Shrinking The Delaware Tax Loophole Other U S States To Incorporate Your Business

Mining For Taxes Raising State Revenues In Nevada Nbm

Form Txr 023 02 Mbt Gb Download Fillable Pdf Or Fill Online Modified Business Tax Return General Business Nevada Templateroller

Nevada Modified Business Tax Form 2019 Pdf Fill Out Sign Online Dochub

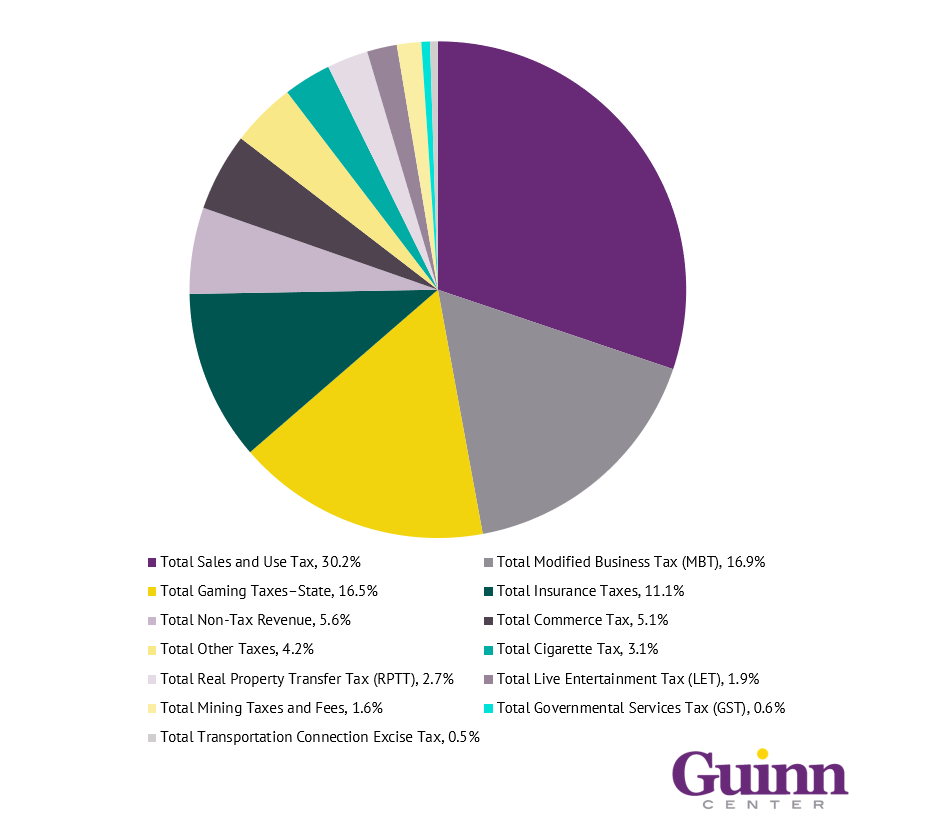

Why Nevada S Tax Base Is More Diversified Than You Think It Is Nevada Policy Research Institute

How To Create An S Corp In Nevada Starts At 49 Zenbusiness Inc

Bill Dentzer Dentzernews Twitter

Free Nevada Payroll Calculator 2022 Nv Tax Rates Onpay

Nevada S May 2021 Economic Forum Guinn Center For Policy Priorities

Nevada Commerce Tax What You Need To Know Sage International Inc