nys workers comp taxes

Sole-Proprietors included on workers compensation coverage must use a minimum payroll amount of 37700 and a maximum payroll amount of. The Division strives to provide employees.

A Complete Guide To New York Payroll Taxes

NYSIFs Climate Action Plan.

. It protects employers from liability for on-the-job injury or illness and provides the following. Employers are required to withhold and pay personal income taxes on wages salaries bonuses commissions and other similar income paid to employees. Workers compensation excludable earnings will be calculated and processed every pay cycle beginning with Administration paychecks dated 81215 and.

Workers Comp Exemptions in New York. In New York state law requires employers to cover all employees with workers compensation and disability insurance. According to guidance from the New York State.

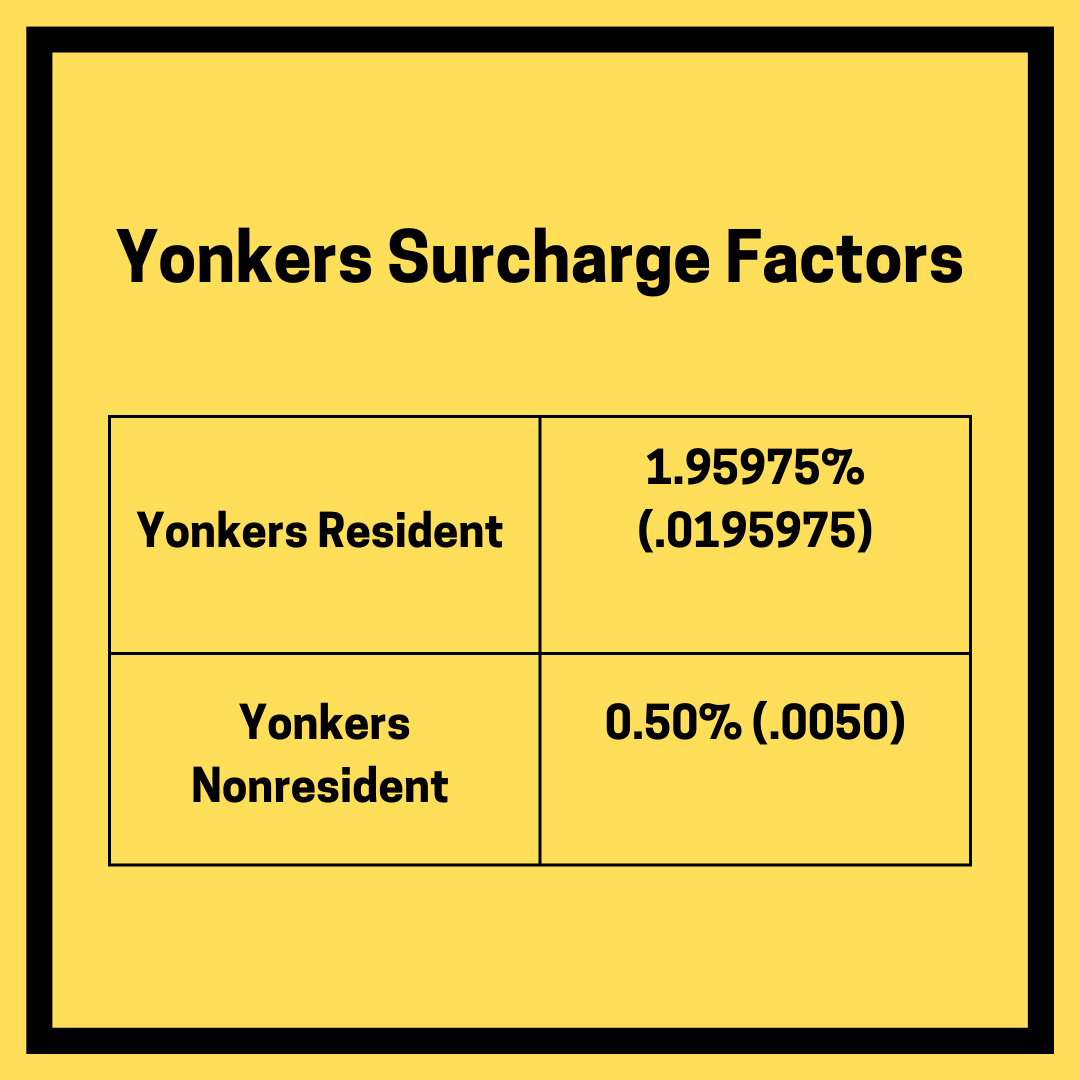

Workers compensation-related benefits are also exempt from New York State and local income taxes if applicable. The IRS in Publication 907 specifically states that workers compensation benefits for job-related sicknesses or injuries are not taxable. Payable to the New York State Department of Taxation and Finance within two and one half months of the close of the reporting period Tax Law Article 33.

OnBoard will be temporarily unavailable for scheduled maintenance from 600 pm. Is Workers Compensation considered income when filing. The amount you receive as workers.

New York State Insurance Fund- SIF. ET Thursday October 6 2022 through. Excluding fire protections his overall budget for 2023 is.

As part of the 2022 State of the State Governor Hochul directed New York State authorities public benefit corporations and NYSIF totaling roughly 40 billion in. If Board intervention is necessary it will determine whether that insurer will reimburse for cash benefits. Workers compensation insurance is mandatory for most employers of one or more employees.

The Workers Compensation Division administers the claims of all covered employees who are injured on the job or incur an occupational disease. 20 Park Street Albany NY 12207 518-474-6670 NY Workers Compensation Board. In New York workers compensation benefits are not considered taxable income for federal state and local tax purposes.

Failure to comply with state workers compensation insurance rules can. 5 hours agoChautauqua towns current tax rate is 076 for town-only residents and 155 for residents who live in the village. Ny state workers compensation rates nys workers comp rates 2020 nys workers compensation rate schedule nys workers compensation insurance rates new york workers compensation.

The Workers Compensation Board is a state agency that processes the claims. The Advocate for Business offers educational presentations on topics important to business such as an. This tax exempt status applies if the worker receives.

NYS Workers Compensation Board - Home Page. Information for Employers regarding Workers Compensation Coverage. According to IRS Publication 525 page 19 workers comp does not generally count as earned income for federal income tax purposes.

When your employees are receiving workers compensation benefits they may wonder if theyll have to pay taxes on them. New York State Workers Compensation Board. Employees in the Company NYS who have a Workers Compensation Board Award for a prior tax year and the Award is Credited to NYS.

The quick answer is that generally workers compensation benefits.

New York City Workers Compensation Lawyers Nyc Work Injury Firm

Ny Workers Compensation Insurance Get Insured Fast

Workers Compensation No Fault Billing Healthcare Billing Services Of Ny

B I C Brokerage Corp New York Ny Facebook

Are Workers Compensation Settlements Taxable

New York Budget Gap Options For Addressing New York Revenue Shortfall

Employer Compensation Expense Tax About New York State S New Payroll Tax

A Complete Guide To New York Payroll Taxes

New York Workers Compensation Insurance Forbes Advisor

How To Delegate Payroll Employee Related Tax Filings And Associated Employer Duties To A Professional Employer Organization The Cpa Journal

New York Workers Compensation How It Works

How The Mta Tax Works In New York

Fmla Vs Workers Compensation Rules What No One Tells You

Nys Workers Compensation Audits

Workers Comp 101 Do Employers Have To Pay For Workers Compensation

The Complete Guide To New York Payroll Payroll Taxes 2022

The Ultimate Guide To Workers Compensation Laws In New York

New York Household Employment Tax And Labor Law Guide Care Com Homepay